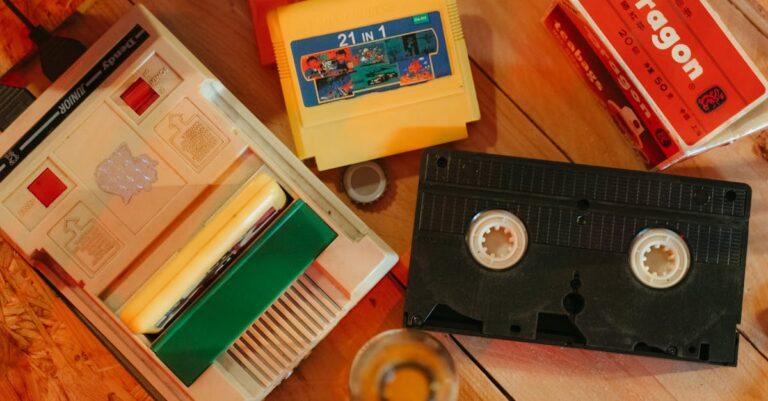

Remember the days when we blew on cartridges, hoping they would work? Old video games aren’t just pixels on a screen: they’re our childhood memories and adventures packed…

For every Dungeons & Dragons player, a dice bag is more than just storage – it’s a reflection of personality and style. Whether you’re a Dungeon Master with…

In DevOps, monitoring and logging are essential practices for ensuring the health and performance of systems. These tools provide the data needed to detect issues early and understand…